A mortgage payment is your monthly cost to borrow money for buying a home. It typically includes principal (paying down the loan), interest (cost of borrowing), taxes, and insurance.

Monthly Payment = Principal + Interest + Taxes + Insurance + PMI (if needed)

For example:

The calculator starts with sample data. Update it with your home details:

Include the ongoing costs of homeownership:

The calculator shows multiple payment breakdowns:

PMI (Private Mortgage Insurance) is required when you put down less than 20%. It typically costs 0.3-1.5% of the loan amount annually and protects the lender if you default.

15-year mortgages have higher monthly payments but lower total interest. 30-year mortgages have lower monthly payments but cost more over time. Choose based on your monthly budget and long-term goals.

Use the 28/36 rule: mortgage payment under 28% of gross income, total debt under 36%. Also consider your down payment, emergency fund, and other financial goals.

Credit score, down payment size, loan type, and current market rates. Higher credit scores and larger down payments typically get better rates.

The calculator doesn't include HOA fees, but you should factor them into your total monthly housing cost when determining affordability.

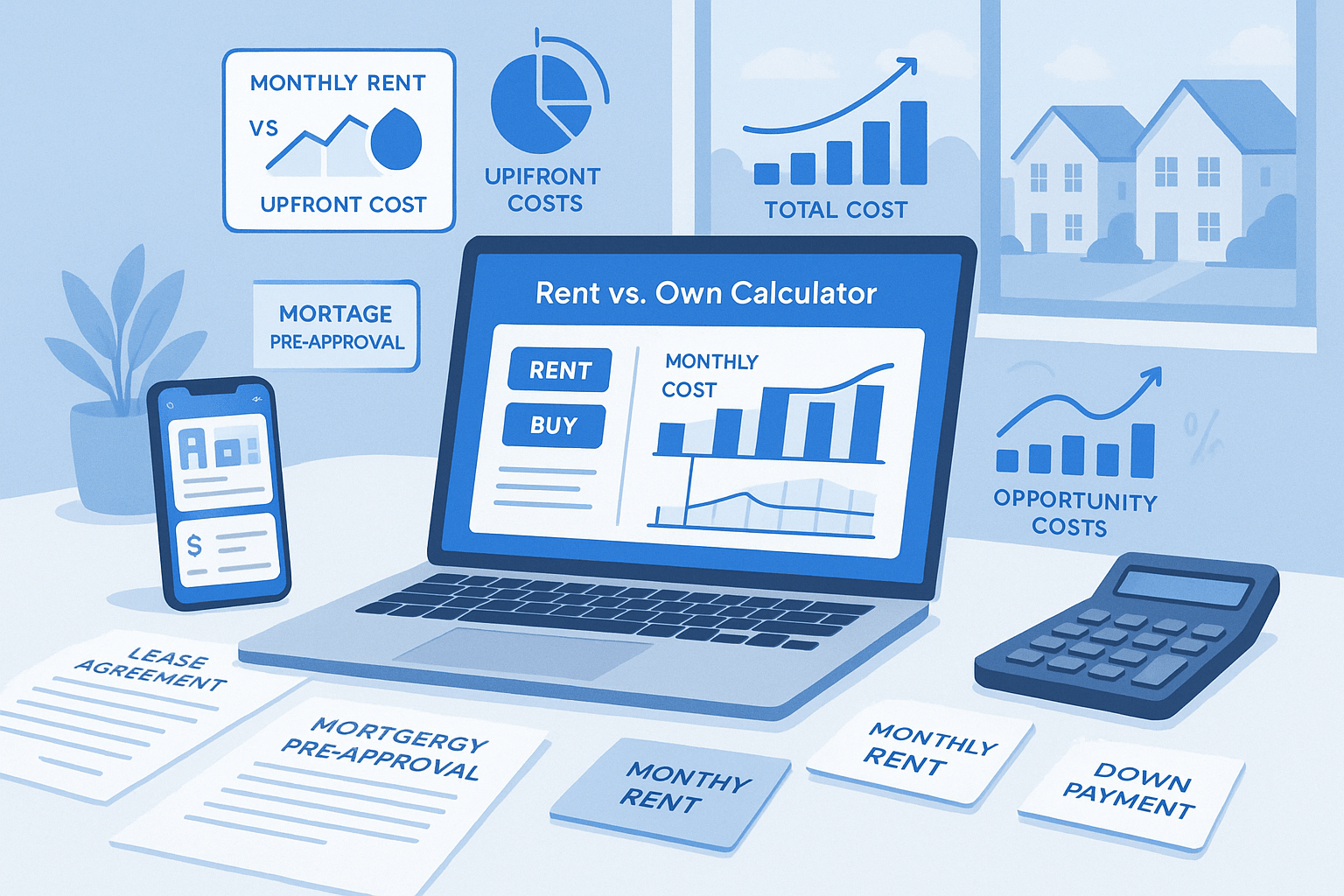

This depends on local rent prices, home appreciation, and how long you plan to stay. Generally 3-7 years, but use the calculator results plus rent comparisons to decide.

Don't let another potential client walk away because you weren't available to respond instantly. Madison's pricing is designed to pay for itself with just one additional deal per month.